Oh my God I'm still so in the old days when everything was easy. I had no idea until I just fell on this that I needed private e-mail. Now I know what was meant by I'm not registered yet. Meanwhile I sent my name my email and country like what's more to register. Sorry Drs finally cut off my anxiety meds and I'm putting the cart before the horse.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Security Info for Newbies

- Thread starter Toker

- Start date

@wait4it what is tails, since getting hacked my family says Im so paranoid about security, but damn my credit was 720, someone stole my identity, i filed a police report got in touch with all 3 credit agencies, but my credit is now down to the 300's. The Denver police dont do anything, I feel like Im fighting an uphill battle by myself, god forbid if anyone here ever has them happen to them. Even with my phone, everything I do now I always need to bring my license to prove its me. God I wish Id read all this before thanks @Toker and @Darlink and others to help prevent another attack!

wait4it

Member

- Joined

- Apr 13, 2015

- Messages

- 260

hi, @ heavenlee -you can find tails info here:

https://tails.boum.org/

That's all i know - asking if anyone uses it and what they think.

You've experienced a common hack - a real pia to get ppl to help. Each level hears the story and begins a scripted interrogation, during which you feel like you are responsible and likely trying to pull a "fast one" on them. And then, after getting it cleared up - it has to start again cuz there is another connection! Its frustrating, unhealthy and an attitude changer.

Blowing off some there...

Anyway, would love to hear from experienced users.

https://tails.boum.org/

That's all i know - asking if anyone uses it and what they think.

You've experienced a common hack - a real pia to get ppl to help. Each level hears the story and begins a scripted interrogation, during which you feel like you are responsible and likely trying to pull a "fast one" on them. And then, after getting it cleared up - it has to start again cuz there is another connection! Its frustrating, unhealthy and an attitude changer.

Blowing off some there...

Anyway, would love to hear from experienced users.

@wait4it good too see a refreshing face, missed you! I agree its very frustrating get I wish I could go back in time and never have gotten credit cards! I swear I showed pictures on VIP chat, dont get involved with Chase Bank! I never was fully restituted and I kept telling them not to send me credit cards, I was so frustrated with the lack of help from the police and credit people, i just paid off charges I know I never made, and after that they sent me 89, i swear i showed the pictures of replacement cards. Citibank was frustrating, but they quit, but now I get a letter every week that I have qualified for a credit card, they get shredded and put in the garbage. I dont know how my bank let $17,000.00 in apple gift cards go through, you would think thats a red flag, but we were reimbursed. I blame my son giving our wifi password to all his friends, some I have found out not to be very good people. Oh i also had a pp charge to freaking China for $500.00. Getting a new router and getting new phones has helped but my information is on the dark web. God I hate hackers!

I actually had to hire an attorney to get my life back! Hes actually helping me get a new social security card, which I never knew it was possible. I was locked out here and Ive had health issues but I didnt want to compromise the board until we had our roouter fixed and hired a security expert to set up a router and vpn. I thank everyones advice, and take it to heart, and they say Apple Iphones and Macbooks cant be hacked is bullcrap. We have two with a big firmware lock on the front. Ill send the, to Music City New Jersey, he replaces the bios and efi chip but not until Im in my new house, thanks again for the commiseration, missed you!

I actually had to hire an attorney to get my life back! Hes actually helping me get a new social security card, which I never knew it was possible. I was locked out here and Ive had health issues but I didnt want to compromise the board until we had our roouter fixed and hired a security expert to set up a router and vpn. I thank everyones advice, and take it to heart, and they say Apple Iphones and Macbooks cant be hacked is bullcrap. We have two with a big firmware lock on the front. Ill send the, to Music City New Jersey, he replaces the bios and efi chip but not until Im in my new house, thanks again for the commiseration, missed you!

@HeavenleeI’m so sorry that happened to you; no one can truly understand what that’s like unless it’s happened to them. It did happen to me many years ago, though I didn’t have so much credit that it destroyed me. I remember the awful phone calls and letters from creditors who pre- judged me to be one to not pay my bills, the disgust in their voices...how they perceived I was making up a story that someone else was using my credit to buy things. They asked me to return all those “electronic toys” I supposedly bought and the clothing, etc. This was before people understood that ID Theft was a real occurrence, not just something that happened to rich people. Now there is better security (can notify your creditors and to some degree, stop from ongoing. It was a long time ago but it still left unpleasant memories. I don’t wish it on anyone. I work in finance now and I’m learning every day the importance of security online; that we need to take aggressive action to protect our information.@wait4it what is tails, since getting hacked my family says Im so paranoid about security, but damn my credit was 720, someone stole my identity, i filed a police report got in touch with all 3 credit agencies, but my credit is now down to the 300's. The Denver police dont do anything, I feel like Im fighting an uphill battle by myself, god forbid if anyone here ever has them happen to them. Even with my phone, everything I do now I always need to bring my license to prove its me. God I wish Id read all this before thanks @Toker and @Darlink and others to help prevent another attack!

It took me years to get things back on track-then several more years to build up a score that was only barely acceptable.

Just yesterday I was doing a search on Google and read a few paragraphs in the terms we agree to when we use anything Google owns. I was shocked-they are bold about saying this:

“When you upload, submit, store, send or receive content to or through our Services, you give Google (and those we work with) a worldwide license to use, host, store, reproduce, modify, create derivative works (such as those resulting from translations, adaptations or other changes we make so that your content works better with our Services), communicate, publish, publicly perform, publicly display and distribute such content. The rights you grant in this license are for the limited purpose of operating, promoting, and improving our Services, and to develop new ones. This license continues even if you stop using our Services (for example, for a business listing you have added to Google Maps)”

There’s more shocking terms than this-this is only a paragraph.

In this papragraph, they pretty much tell you -from what you write in your Gmails, to anything else-they can not only read it and modify it, they can use it any way they want. This includes ANY photos, contacts, anything. They can use it for promoting their services. You name it-we givethem permission just by using their wares.

An old IT friend has always said to me; “Do not put, or do anything online that you wouldn’t want the whole world to know, because that’s where it will be, and remain.

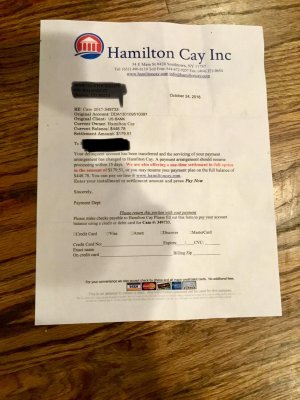

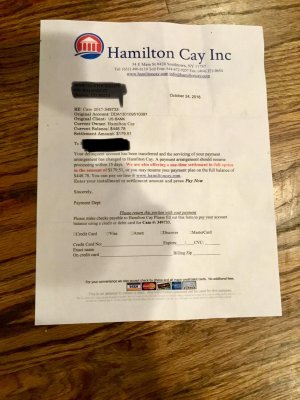

@Darlink thank you so much it’s like fighting an uphill battle that’s why I finally hired an attorney because I am getting no where. The police are no help at all, I don’t think people take identity theft seriously until it happens to you. I thank you to know that there could be an end to this, and I feel awful for you knowing you went through this hell. That article you quoted is scary as hell! I am done with ever putting any debit or credit cards on my devices I now only use prepaid cards. Its so nice to have someone that can commiserate with your agony. I thought it was over with getting so many credit cards but yesterday I got this letter in the mail and they didn’t even have my last name correctly ! I immediately called my bank which is US bank but need to change because I am moving where there’s none down there which is scary I have an account and cc in Denver but Chase turned me down because my credit has been destroyed even using lifelock and assurion are useless! Anyway the bank said its a phishing letter I don’t owe them anything because I paid them off and put my debit and credit card out of commission until I clear my name. But looking back Im wondering now if I have paid more phishing letters sent to me. I cant wait until Monday morning so I can look at a printout of my bank statements. This is what came and they assured me it’s totally fake! Thanks for your help it’s much appreciated!

@HeavenleeYou have my sympathies-it’s total hell. I still receive cards from time to time with my name correct but a bill for something/from someone I had nothing to do with. Since I began working in the finance industry, I have learned some of the slick moves the collectors try on innocent people:

Take a common name like, Joeseph Brown. Somewhere, the real Joe here racked up a bunch of debt and now no one can reach him. When they mail him The bills they’re returned and the phone number has changed. So, the collection agencies do a search and send a collection letter/card to every single “Joseph Brown.” They only give an account number, city or state where charges incurred- or a phone number to call; just enough info to make you angry bc you know you don’t owe this bill. Then, when all the innocent Joe’s get the letter/post card saying they owe all this money and they’re going to mess with their credit, the collector goes by process of elimination. The Joe’s that call to verify that in fact it is not their bill (collector calls out a Social Security number, an address, etc. and asks if it’s yours), the collector marks it off the list. Then after a certain period of time-all the other “Joseph Browns” get a ding on their credit. The collector gets points for it and in some cases they get a bonus, which is not as much as if they had located the correct Joe and worked out payment arrangements, but commision is commission.

So here’s something I have my clients do before I work with them and it doesn’t effect your score whatsoever. It’s not a soft-pull or a hard pull, doesn’t count as an inquiry-it’s nothing when you yourself check it, and it’s free/low cost:

Go to one of the credit monitoring agencies which offer to provide all 3 of your credit reports including FICO scores and register with them. Typically, they are “free” or a $1.00 fee is charged, like a trial basis. Print out all of your reports/scores and keep the service if you like it. I’m pretty straight up so I’m not recommending every one Cancel it after you get a free report. Many of these credit monitoring site links are the all the same company and for the most part, are pretty much worth having. If you don’t want it, cancel it in writing or call (whatever the terms say to do) and keep that confirmation so you aren’t billed monthly! If you keep it, make sure it’s one that will notify you email or text or call you if anyone tries to open an account, accesses your credit info or otherwise makes a credit inquiry.

(BTW-if you have more than 3 credit inquiries in 6 months, it will harm your credit. Just fyi).

Go through your reports and dispute everything negative that is incorrect. On debts that are over 7 years old, Do not ever admit, “I paid that” or “I don’t owe that much” or otherwise say it is your debt unless you can prove it’s paid or is being paid. If you do, they will start all over with the 7 year wait to get it removed from your file. If you owe the money-pay it if that’s your intention. Disputes are usually handled within 30 days.

Doing this one thing can dramatically raise your credit score.

If you’re buying a house or other major purchase, it’s worth it to find one of those companies that will remove derogatory items for you, but use a company that only charges you when they get something removed. (Why pay on a monthly basis? Where’s their incentive to help you NOW with your credit if you pay them monthly? They can sit back and do one a month-no help!)

@Heavenleeso right about having ONE CARD to make payments online! That’s one thing I need to do this week!

Sorry for the rant-it makes me so mad to know these underhanded things go on and usually to people who pay their bills and do what they can to be straight and honest.

(I do not work in credit repair, for a monitoring company, a bank--so you know. Just a few tips that might help in your battle dear @Heavenlee.

Got to get off these late-day triple espressos!

Hope it gets straightened out soon, wishing you the best.

Take a common name like, Joeseph Brown. Somewhere, the real Joe here racked up a bunch of debt and now no one can reach him. When they mail him The bills they’re returned and the phone number has changed. So, the collection agencies do a search and send a collection letter/card to every single “Joseph Brown.” They only give an account number, city or state where charges incurred- or a phone number to call; just enough info to make you angry bc you know you don’t owe this bill. Then, when all the innocent Joe’s get the letter/post card saying they owe all this money and they’re going to mess with their credit, the collector goes by process of elimination. The Joe’s that call to verify that in fact it is not their bill (collector calls out a Social Security number, an address, etc. and asks if it’s yours), the collector marks it off the list. Then after a certain period of time-all the other “Joseph Browns” get a ding on their credit. The collector gets points for it and in some cases they get a bonus, which is not as much as if they had located the correct Joe and worked out payment arrangements, but commision is commission.

So here’s something I have my clients do before I work with them and it doesn’t effect your score whatsoever. It’s not a soft-pull or a hard pull, doesn’t count as an inquiry-it’s nothing when you yourself check it, and it’s free/low cost:

Go to one of the credit monitoring agencies which offer to provide all 3 of your credit reports including FICO scores and register with them. Typically, they are “free” or a $1.00 fee is charged, like a trial basis. Print out all of your reports/scores and keep the service if you like it. I’m pretty straight up so I’m not recommending every one Cancel it after you get a free report. Many of these credit monitoring site links are the all the same company and for the most part, are pretty much worth having. If you don’t want it, cancel it in writing or call (whatever the terms say to do) and keep that confirmation so you aren’t billed monthly! If you keep it, make sure it’s one that will notify you email or text or call you if anyone tries to open an account, accesses your credit info or otherwise makes a credit inquiry.

(BTW-if you have more than 3 credit inquiries in 6 months, it will harm your credit. Just fyi).

Go through your reports and dispute everything negative that is incorrect. On debts that are over 7 years old, Do not ever admit, “I paid that” or “I don’t owe that much” or otherwise say it is your debt unless you can prove it’s paid or is being paid. If you do, they will start all over with the 7 year wait to get it removed from your file. If you owe the money-pay it if that’s your intention. Disputes are usually handled within 30 days.

Doing this one thing can dramatically raise your credit score.

If you’re buying a house or other major purchase, it’s worth it to find one of those companies that will remove derogatory items for you, but use a company that only charges you when they get something removed. (Why pay on a monthly basis? Where’s their incentive to help you NOW with your credit if you pay them monthly? They can sit back and do one a month-no help!)

@Heavenleeso right about having ONE CARD to make payments online! That’s one thing I need to do this week!

Sorry for the rant-it makes me so mad to know these underhanded things go on and usually to people who pay their bills and do what they can to be straight and honest.

(I do not work in credit repair, for a monitoring company, a bank--so you know. Just a few tips that might help in your battle dear @Heavenlee.

Got to get off these late-day triple espressos!

Hope it gets straightened out soon, wishing you the best.

@Darlink you are so sweet and helpful I feel like I have finally got a guardian angel looking out for me you are awesome. Thanks so much for your time writing all the helpful information down for me, I feel so special you took the time out to help me and I will take all your advice I promise, it definitely sounds like you know exactly what I am going through and how to finally fix it, my shit for brains attorney charged me $4000.00 and I am no better off. No he was actually my attorney when I was busted for illegal cultivation so I do know him. You have helped me feel much better than him! God I should have known better to get him I went to jail and my husband who has a way more expansive history with the law bought his way out, he got four months probation and my attorney got me a wonderful stay at a locked down treatment facility I had to deal with that crap for an entire year! And it was a locked down jail, no windows, I had to speak to my husband through the phone with the glass between us. I didn’t let my son visit except one time he cried seeing me locked down I could not do it to him., we thought it was because it was my first felony the judge would give me probation but I should have known better when I heard him called maxout Mallory and I had a misdemeanor for xanax and his name was longride McBride! I could have shot myself! That was years ago and I did get some good out of it looking back!

Oh that letter above I went to the website and it says if anyone wants to claim this site hit hear, i was so pissed I called them and said I am turning this letter to the cops, but no one answers it’s just a voice mail. Total bullshit phishing mail!

I cant thank you enough for your help you have no idea how much it’s appreciated and to see and meet great people here that are willing and unselfish to help others. You’re absolutely golden!

thanks so much

love you

heavenlee

Oh that letter above I went to the website and it says if anyone wants to claim this site hit hear, i was so pissed I called them and said I am turning this letter to the cops, but no one answers it’s just a voice mail. Total bullshit phishing mail!

I cant thank you enough for your help you have no idea how much it’s appreciated and to see and meet great people here that are willing and unselfish to help others. You’re absolutely golden!

thanks so much

love you

heavenlee

Last edited by a moderator:

@wait4itDid you decide to go with the refurbished Dell? I met someone who moderates a supplement forum and he is king when it comes to computers. I was a little apprehensive at first but learned he has a brick/mortar business, does it for a living. He became very sick and I wanted to help someway, he's a great guy. So I bought a pc from him. haha Bought refurb Dell M6700 (good price! I have gamers trying to buy it off me all the time, it's good as Alien-ware and it is a workhorse! Bought it when I was in the field as an adjuster-had to run some "hogware" (software which takes a lot of space.) Now I use it to run my business and it still works great. Does everything I need. Has room to add memory galore and if nothing else, it's so heavy I can use it as a weapon, or to protect myself! lolWill be receiving a refurbished dell xps w/win10 64 bit os next wk. Id like to set it up out of the box so it is secure & activity is anonymous.

Is there a goo step by step forum / topic summary that advises a process?

It's refurb, so i suuppose i gotta ck 1st to see if something was left behind - .

what do friends know od windscribe as vpn. I have it, dont know much.

I am also confused: when i turn on laptp it connects to isp. so wen i turn on vpn, the isp knows?

But cannot access nor see any site search history. This about right?

Thanks.

I used Windscribe for a while but decided to go back to VPN Express; good Cust Serv and no issues except sometimes it's slow to connect to certain sites. But I love my Dell, wish I knew how to use all it can do.

@HeavenleeWere you able to get any answers? I recently found a different credit repair company where I now send my clients who need funding but have low credit/FICO scores. These guys are fast and they don't charge anywhere close to thousands of dollars...I would give some names but not sure if it's permitted. Just wanted to share something that may help-there's something called "Tradelines." If you still have any credit issues, this is an answer to a prayer! Anyone can do this.@Darlink you are so sweet and helpful I feel like I have finally got a guardian angel looking out for me you are awesome. Thanks so much for your time writing all the helpful information down for me, I feel so special you took the time out to help me and I will take all your advice I promise, it definitely sounds like you know exactly what I am going through and how to finally fix it, my shit for brains attorney charged me $4000.00 and I am no better off. No he was actually my attorney when I was busted for illegal cultivation so I do know him. You have helped me feel much better than him! God I should have known better to get him I went to jail and my husband who has a way more expansive history with the law bought his way out, he got four months probation and my attorney got me a wonderful stay at a locked down treatment facility I had to deal with that crap for an entire year! And it was a locked down jail, no windows, I had to speak to my husband through the phone with the glass between us. I didn’t let my son visit except one time he cried seeing me locked down I could not do it to him., we thought it was because it was my first felony the judge would give me probation but I should have known better when I heard him called maxout Mallory and I had a misdemeanor for xanax and his name was longride McBride! I could have shot myself! That was years ago and I did get some good out of it looking back!

Oh that letter above I went to the website and it says if anyone wants to claim this site hit hear, i was so pissed I called them and said I am turning this letter to the cops, but no one answers it’s just a voice mail. Total bullshit phishing mail!

I cant thank you enough for your help you have no idea how much it’s appreciated and to see and meet great people here that are willing and unselfish to help others. You’re absolutely golden!

thanks so much

love you

heavenlee

The way it works is this:

There are individuals who have credit cards with high limits and good payment history-like 12K up to-20K limits and have had them for 5-10 years. These people knowingly agree to participate in this program and are paid to sort of 'rent' out their card for 2-3 months at a time.

Along comes a man who wants to buy property or a house, but his credit is 500 (very bad). So we send him -we'll call JOE-to credit repair. Joe signs with the credit repair company I mentioned and the good credit card, or Tradeline, is added to Joe's account. Joe is named as an authorized user of this card. Now Joe doesn't get to use the card, however-all those years of good payment history are now transferred onto Joe's credit report. This causes his score to go wayyy up! He can access 2 of these cards, depending on how much help his FICO needs. The staff there will advise.

This is perfectly legal, although some argue it may not be ethical. (I had to run it by the legal team to make sure we weren't breaking any laws before offering his service to clients).

Maybe something like this will help you @Heavenleeand it won't take years, but rather 2-3 months to build up your credit again! Hope you'll let me know how it goes if you try it out.

wait4it

Member

- Joined

- Apr 13, 2015

- Messages

- 260

@Darlink - yeah got a business latitude and an inspiron 11, 2 in one. set-up is pia.

In addition to rec vpn, take a look @ protonmail's product.

Been reading about TAILS, a part of the tor project. the way i read thar assist is vpn not necessary. Anyone use it?

In addition to rec vpn, take a look @ protonmail's product.

Been reading about TAILS, a part of the tor project. the way i read thar assist is vpn not necessary. Anyone use it?

Hey I'm using protonmail... what's shit about it and what makes elude better?ProtonMail is shit. Sorry.

Elude & Secmail

can get one of each

Elude for Clearnet

Secmail for non-clearnet.

- Joined

- Feb 5, 2019

- Messages

- 861

I am using NordVPN strictly for P2P Torrenting to hide it and only because my brother pays for it and I am using his account. I don't think a VPN makes u anymore safe than just using your ISP if you want security use Tor Browser not a VPN which are shady all of them even the best a lot of them but it depends on who you trust more your Internet Service Provider or your VPN but a VPN does not have any Legal trouble they can get into I just believe a VPN is a false sense of security and Tor Browser is a real security measure that can be used and used easily just my 2 cents.

Which one is $4 a month?It was very inexpensive also, the only cost was $4 a month for the vpn. well worth the money for the security and I had been looking for a vpn anyway. Now I can watch movies without worrying about johnny law, lol.

LaVidaLoca

Member

- Joined

- Aug 30, 2019

- Messages

- 19

Many say TrueCrypt is no longer secure but I can confirm TrueCrypt remains very secure! I only trust TrueCrypt 7.1a !

VeraCrypt is still very young! If you want to use VeraCrypt please encrypt the main system with TrueCrypt and the virtual machine with VeraCrypt. Of course two different passwords!

VeraCrypt is still very young! If you want to use VeraCrypt please encrypt the main system with TrueCrypt and the virtual machine with VeraCrypt. Of course two different passwords!

Toker you’re correct about Protonmail not encrypting they’re SUBJECT LINE. Sometimes it’s easy to forget but it’s important to keep this in mind!Hi all, just thought i'd start a topic that may help out newbies along the road to securing there online activities.

1) Get yourself a safe and secure email provider. (Protonmail is MY preferred choice)

2) Get yourself a decent VPN. (Trust.Zone is MY preferred choice)

3) Use a decent up to date browser. (Firefox is MY preferred choice)

Now, some explanation. Protonmail is a Secure email provider that sends only encrypted mail which can not be read by any "Man in the Middle" attacks. I.E. When the mail leaves your device it's transferred in a mumbo jumbo of code until it reaches the recipient.

A decent VPN like Trust.Zone will protect all your online activities as it creates a secure encrypted connection to a server in a country of your choice.

A decent browser like Firefox lets you use a "Private Window" meaning no data like Browsing history, Cookies, Logins etc are kept on your device.

Don't use g@@gle to do your searching, use something like DuckDuckGo which has No tracking, no ad targeting and no Data collection policy's

There are many VPN's on the market, have a look here - Simple-VPN-Comparison-Chart

In my mind these are just three of the Starting steps that people should practice to keep there online activities safe and secure from prying eyes.

There is more that i could go into like using PGP and so forth, but for your average person the 3 points above will suffice.

Other members please feel free to add any additional information you feel may be of use to others.

Regards, T

Thanks, Nitetrain

- Joined

- Mar 16, 2019

- Messages

- 541

I keep reading about security, but I was wondering, If I'm just buying RC's that are legal in my state, do I need to take any kind security to help keep me safe> As of right now,, I'm strictly a rc kinda gal...

-

@

Thoth:

Happy Weekend! Let’s Get It!!!

@

Thoth:

Happy Weekend! Let’s Get It!!!

-

@

cannedgoods:

Happy Weekend everybody! cheers!

@

cannedgoods:

Happy Weekend everybody! cheers!

-

@

rasetreydir:

@Dr-Octagon, whatchyamicallit (if in fact spelled like that)

@

rasetreydir:

@Dr-Octagon, whatchyamicallit (if in fact spelled like that)

-

@

rasetreydir:

Good Morning to you all. To those struggling, it's always darkest before dawn.

@

rasetreydir:

Good Morning to you all. To those struggling, it's always darkest before dawn.

- R @ rhodium: good morning

-

@

Dr-Octagon:

Zero and Almond Joy

@

Dr-Octagon:

Zero and Almond Joy

-

@

proton369:

💎💎💎💎💎💎💎💎

@

proton369:

💎💎💎💎💎💎💎💎

-

@

tiquanunderwood:

Can't fucking wait. Works been nutty the last couple weeks.

@

tiquanunderwood:

Can't fucking wait. Works been nutty the last couple weeks.

-

@

tiquanunderwood:

Happy almost Friday everyone!

@

tiquanunderwood:

Happy almost Friday everyone!

-

@

DawsonCheeks:

I don’t mesn to spam but every mid type posts!!

@

DawsonCheeks:

I don’t mesn to spam but every mid type posts!!

-

@

DawsonCheeks:

Take it from mez

@

DawsonCheeks:

Take it from mez

-

@

DawsonCheeks:

SunnySide is shining again! Take it from

@

DawsonCheeks:

SunnySide is shining again! Take it from

-

@

shoutback:

Okay I could dig that but working that shit out at the gym is going to be rough

@

shoutback:

Okay I could dig that but working that shit out at the gym is going to be rough

-

@

Realbenzeyes:

Butterfingers in a milkshake. Nothing like it

@

Realbenzeyes:

Butterfingers in a milkshake. Nothing like it

-

@

Gulp2788:

Twix kangs rise up

@

Gulp2788:

Twix kangs rise up

- L @ Layne_Cobain: Snickers almond FTW 🙌

- L @ Layne_Cobain: Yes the mars almond was in a white-ish wrapper

-

@

Maelstrom:

Oh god! Way too much nuance and variation between Mars, Milky Way, and 3 musketeers. There’s was a special mars that had almond. A Mars bar from the UK is closer to a snickers than a traditional mars. What a rabbit hole though.

@

Maelstrom:

Oh god! Way too much nuance and variation between Mars, Milky Way, and 3 musketeers. There’s was a special mars that had almond. A Mars bar from the UK is closer to a snickers than a traditional mars. What a rabbit hole though.

- S @ sawganaut: Snobording ok skiisss

-

@

proton369:

💎💎💎💎💎💎💎💎

@

proton369:

💎💎💎💎💎💎💎💎